In 2023, Tanzania revisited its position on open skies agreements, reflecting the delicate balance between liberalizing its aviation market and protecting its national airline, Air Tanzania. While the East African region has largely embraced liberalized skies to boost competition and connectivity, Tanzania has taken a cautious approach. The government sought to review how far to open its airspace, weighing opportunities for tourism and trade against concerns about foreign dominance in the market.

Tanzania’s Strategic Position

Tanzania is a major hub for tourism, with attractions like Mount Kilimanjaro, Zanzibar, and Serengeti National Park drawing millions of visitors annually. Aviation plays a critical role in sustaining this sector, making air connectivity a national priority.

While the Yamoussoukro Decision and the Single African Air Transport Market (SAATM) encourage African states to liberalize skies, Tanzania has historically resisted full compliance. Instead, the government selectively negotiates bilateral air service agreements (BASAs) to control access and protect domestic operators.

Policy Review Developments in 2023

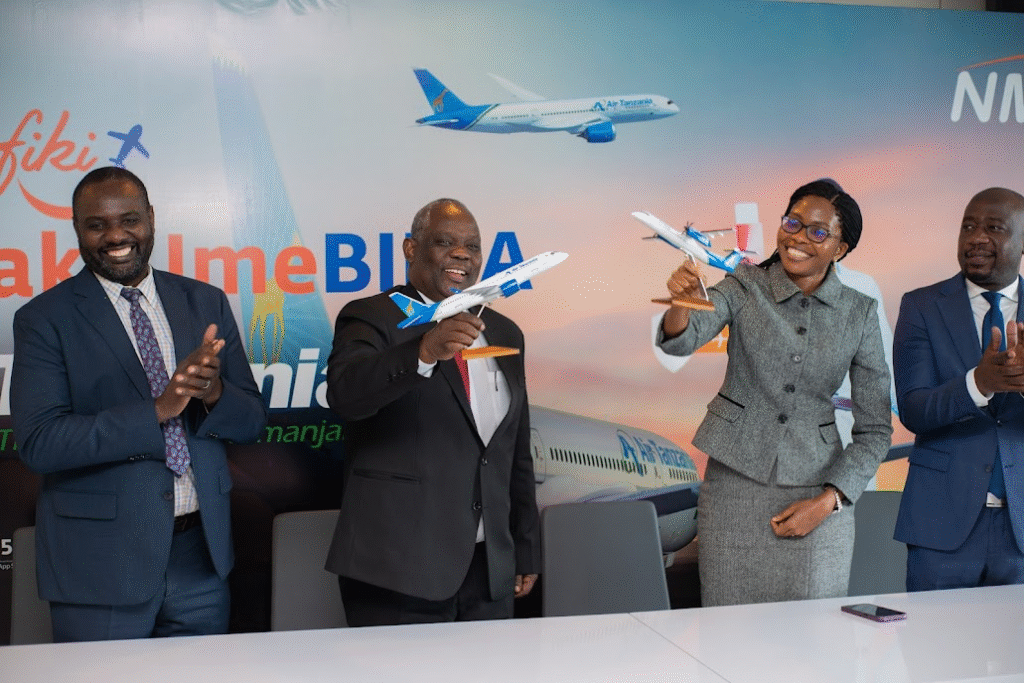

- Air Tanzania’s Expansion: The government invested in Air Tanzania’s fleet expansion, acquiring new aircraft including Boeing 787 Dreamliners and Airbus A220s. The review emphasized the importance of shielding the carrier from intense foreign competition until it gains stronger market footing.

- Tourism Considerations: Tanzania acknowledged that easing air access could significantly boost tourism. However, policymakers argued that uncontrolled liberalization might allow Gulf carriers and regional competitors like Kenya Airways and Ethiopian Airlines to dominate, marginalizing Air Tanzania.

- Bilateral Agreements Over Full Open Skies: Instead of fully joining SAATM, Tanzania strengthened bilateral agreements with select partners, ensuring foreign airlines operate under negotiated conditions that safeguard national interests.

- Regulatory Adjustments: The Tanzania Civil Aviation Authority (TCAA) updated its guidelines to streamline licensing for foreign airlines while maintaining a requirement for reciprocity in market access.

- Stakeholder Consultations: In 2023, the Ministry of Works and Transport held consultations with tourism boards, airlines, and private investors to align aviation liberalization with Tanzania’s economic priorities.

Economic and Regional Implications

Tanzania’s careful stance has mixed implications:

- Positive:

- Protects Air Tanzania during its growth phase.

- Gives the government leverage in negotiations with larger foreign carriers.

- Ensures national economic benefits from controlled liberalization.

- Negative:

- May limit Tanzania’s competitiveness as a regional aviation hub compared to Kenya and Ethiopia.

- Could reduce the number of direct international flights, keeping airfares relatively high.

- Slows integration with the wider East African aviation market, affecting trade and connectivity.

Challenges Identified

- Balancing Protectionism with Growth: Too much protection risks limiting passenger choice and stalling tourism growth.

- Compliance with Continental Goals: Tanzania’s cautiousness runs counter to continental initiatives like SAATM, which aim to unify African skies.

- Air Tanzania’s Financial Struggles: Despite investments, the airline continues to face operational and financial challenges, raising questions about long-term sustainability.

- Regional Competition: Neighboring hubs like Nairobi and Addis Ababa continue to capture significant transit traffic, making it harder for Dar es Salaam to emerge as a regional leader.

In summary

Tanzania’s 2023 review of its open skies policy underscored the government’s strategic dilemma: how to embrace liberalization without jeopardizing the growth of its national airline. By favoring selective bilateral agreements over blanket liberalization, Tanzania prioritized national interests while keeping the door open for future integration. The success of this cautious approach will depend on Air Tanzania’s ability to become competitive and the government’s readiness to align more fully with regional and continental aviation frameworks in the coming years.